I hear all the time that nuclear power is so heavily subsidized it can’t survive on its own. Well we’re going to finally get into this issue as well as discuss the subsidies received by all other energies and technologies.

In Issues Online which is a publication by four groups including the National Academy of Sciences, an article titled The U.S. Energy Subsidy Scorecard was published quantifying the energy subsidy topic. The article was written by Roger H. Bezdek, president of Management Information Services, Inc., an economic research firm in Washington, D.C. and Robert Wendling, the vice president of MISI.

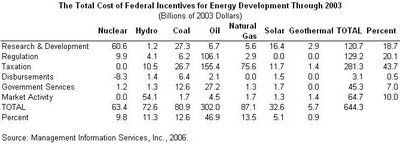

When I see claims that nuclear power gets all the subsidies, the numbers that are cited are typically only the Research and Development dollars. This has some merit because according to the table below, nuclear has received about half of the total dollars spent on R&D since 1950. However, I never see subsidies quantified by the opponents beyond R&D. This table shows subsidies beyond R&D and is from another article published by bcc Research written by the same two individuals from MISI (subscription required).

According to the first article, R&D only accounted for 19% of the total subsidies received from 1950 to 2003. The opponents paint the picture that nuclear power receives the most subsidies yet in fact, nuclear power has received about 10 percent of the total Federal incentives. From the article:

Check out these charts below from the article.Indeed, our analysis makes clear that there are diverse ways in which the federal government has supported (and can support) energy development. In addition to R&D and tax policy, it has used regulatory policy (exemption from regulations and payment by the federal government of the costs of regulating the technology), disbursements (direct financial subsidies such as grants), government services (federal assistance provided without direct charge), and market activity (direct federal involvement in the marketplace).

We found that R&D funds were of primary importance to nuclear, solar, and geothermal energy. Tax incentives comprised 87% of subsidies for natural gas. Federal market activities made up 75% of the subsidies for hydroelectric power. Tax incentives and R&D support each provided about one-third of the subsidies for coal.

As for future policy, there appears to be an emerging consensus that expanded support for renewable energy technologies is warranted. We found that although the government is often criticized for its failure to support renewable energy, federal investment has actually been rather generous, especially in light of the small contribution that renewable sources have made to overall energy production. As the country maps out its energy plan, we recommend that federal officials pay particular attention to renewable energy investments that will lead to market success and a larger share of total supply.

So if nuclear can’t survive without subsidies, what energy technology can? By our opponent’s logic; hydro, coal, oil and natural gas cannot survive without government help either. What about the other renewables and geothermal? I'll let the reader decide if they are really surviving without government help (pdf).

Price Anderson Act and the Nuclear Waste Fund

We say that the Price Anderson Act and the Nuclear Waste Fund are not a subsidy. Yet, according to some of our opponents they are subsidies. By looking at the data in the article it appears they include both of these monies in their analysis under Disbursements from the table above. However, it is not a payment by the federal government. It’s the exact opposite.

Since the industry pays for its own waste by paying one mill of a cent / kWh into the Nuclear Waste Fund, this payment is subtracted from the total subsidies received. Thus why you see a -$8.3B under Disbursements for nuclear.

Since the Price Anderson Act was created, only about $151 million have been paid out in claims by the industry ($70M for Three Mile Island and $65M by DOE). According to Wikipedia:

Power reactor licensees are required by the act to obtain the maximum amount of insurance against nuclear related incidents which is available in the insurance market (as of 2005, $300 million per plant). Any monetary claims that fall within this maximum amount are paid by the insurance company. The Price-Anderson fund, which is financed by the reactor companies themselves, is then used to make up the difference. Each reactor company is obliged to contribute up to $95.8 million in the event of an accident. As of 2006, the maximum amount of the fund is approximately $9.5 billion if all of the reactor companies were required to pay their full obligation to the fund. This fund is not paid into unless an accident occurs.And if the accident costs beyond $9.5B:

...then the President is required to submit proposals to Congress. These proposals must detail the costs of the accident, recommend how funds should be raised, and detail plans for full and prompt compensation to those affected. Under the Act, the administrators of the fund have the right to further charge plants if it is needed.Considering that the U.S.’ worst nuclear accident (TMI, 1979) paid $70M in compensation, a $9.5B cap appears to be ample enough.

Moving on. The only issue lacking in this post is information on the incentives from the Energy Policy Act of 2005. This is something I hope to cover later in the future so stay tuned for more posts. As for now, enjoy the information on energy subsidies over the past half century.

Technorati tags: Nuclear Energy, Nuclear Power, Energy, Politics, Technology, Economics, Subsidies

0 comments:

Post a Comment