This last part discusses Paul Gipe’s analysis of nuclear’s costs and risks which was based on questionable assumptions from a California Energy Commission study, a report published in German by the country’s renewable energy association, and an unknown study on energy externalities.

Let’s get into it. From Mr. Gipe:

The CEC's 186-page report, "Comparative Costs of California Central Station Electricity Generation" [PDF], found that a 1,000-megawatt pressurized water reactor would generate electricity in 2018 from as little as $0.17 per kilowatt-hour to as much as $0.34 per kilowatt-hour.

The study from the California Energy Commission was published in January 2010, more than a year ago. Yet the first sentence in his Grist post says the “nuclear industry continues to take a battering,” suggesting that he’s offering new information and that one report from California constitutes battering.

There is new info since January 2010 but it’s not mentioned in Mr. Gipe’s post. For instance, the Energy Information Administration has been providing updated levelized cost numbers every year for a few years now. This year, 2011, EIA provided a range of likely costs for each technology (not averages), just like the California report.

According to EIA’s numbers, the range for nuclear is 11-12 cents/kWh, much lower and less dramatic than CEC’s 17-34 cents/kWh. Hmm, what gives? Of course, it’s the assumptions.

When the CEC report came out more than a year ago, we looked closely at their data to see how they derived their results. One of the big eye-catchers was their assumptions for capital costs. For some reason, which their methodology doesn’t adequately explain, their assumptions reject learning curves for nuclear, and predict that nuclear’s costs rise faster than inflation. Below is the chart from page 6 showing the result of these bogus assumptions: nuclear is the top line.

When digging a little further, according to the CEC’s backup report (p. 151, PDF), the consultants relied on “two MIT studies, research from the OECD Nuclear Energy Agency, the International Energy Agency, and several other metastudies” for nuclear construction costs.

Well, according to a supplemental paper to one of the two MIT studies, recent overnight nuclear cost data is indeed available to analyze learning curves (see page 45 of 66, PDF).

To put the numbers in perspective, the costs of the eleven nuclear units in the MIT supplemental paper were plotted in the chart below based on time and technology type.

As one can see, the capital costs for a particular reactor type all decline after subsequent units are built. This clearly shows learning curves. The CEC reports fail utterly to incorporate this knowledge from their own cited sources, apparently electing to disregard distasteful sections, and assume something entirely opposite.

There are a number of other questionable assumptions in the CEC report that have the effect of skewing nuclear’s costs higher:

- Fixed and variable O&M costs are nearly twice as high as EIA’s.

- The CEC assumes a capacity factor of 86%, many others assume 90%.

- The capacity of the AP1000 is 1,150 MW, but CEC assumes only 960 MW - a nearly 200 MW deduction that could mean more revenue and production.

- And CEC assumes several financial factors such as the percent of equity, interest on debt, and length of repayment that are debatable and can dramatically affect results.

Of all the nuclear numbers issued from academics, analysts and policy wonks, the numbers to read first are the ones from the utilities building the stations. That’s because they’re the ones who know their territories, market demands, credit worth, costs of competing technologies and other data to make their numbers work for various projects. Nuclear plants are efficient and powerful energy producers, but they are not status symbols or investments made frivolously.

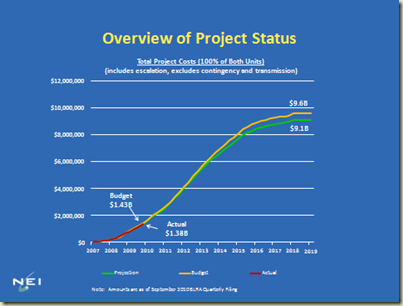

As an example, below is the spending curve for the AP1000 at Summer units 2 and 3. We noted this in our Wall Street presentation on page 16 (pdf).

The total construction cost for those two units is projected to come out at about $3,700/kW.

To add, below is a snapshot of our chart on page 5 showing estimates from publicly available regulatory filings.

In terms of capital and levelized costs, the CEC report is clearly an outlier. The latest MIT study calculated levelized costs at 6.6-8.4 cents/kWh (PDF, page 6), EIA was 11-12 cents/kWh and the IEA was 2.9-13.7 cents/kWh depending on the country and discount rate (PDF, page 8).

CEC cited, mentioned, and incorporated portions of these studies, yet CEC’s own conclusions somehow managed to differ wildly. If the universally acknowledged sources for energy market data and forecasts are MIT, EIA, IEA, and a few others, what special knowledge did CEC obtain, yet fail to cite? Did CEC allow bias and subjectivity to skew their analysis? Does this affect the reliability of Mr. Gipe’s policy pronouncements, or was he just editorializing, after all?

Enough about costs.

Is Nuclear Uninsurable?

Here’s Mr. Gipe’s claim:

In an unrelated study for the German Renewable Energy Association, consultants found that nuclear reactors are effectively uninsurable. The 157-page report [PDF] by Versicherungsforen Leipzig estimated that the premium necessary to insure a nuclear reactor from accident would cost from $0.20 per kilowatt-hour to a staggering $3.40 per kilowatt-hour.

Hmm, two things. One - if an argument is written in one language but relies entirely on a study in another language, the argument would carry more weight if a translation was provided, or another study, if there is, by chance, any other study that supports one’s argument.

Two – it might be good to thoroughly read through the reports that one references, even if one’s just typing out a hit-job on the fly. It is unnerving to be discredited by one’s bibliography.

On page 30 in the CEC report that Mr. Gipe cites and relies on, there is in fact a column showing the estimated cost of insurance for various technologies (chart pasted below).

Mr. Gipe may not have studied closely those portions of the CEC report he found distasteful (we can’t blame him), but besides nuclear, CEC also assumes an insurance cost of $10/MWh for offshore wind and more than $13/MWh for solar. If nuclear is “uninsurable,” then solar is catastrophic.

Here’s Mr. Gipe again:

Earlier German studies of the cost for insuring reactors against catastrophic failure found similar results. A 1999 report for the European Commission on the externalities of energy found that the external cost of nuclear power was $2.59 per kilowatt-hour largely due to the cost of insurance.

It would be helpful if there was a link or a title of the European Commission report being referenced here. That’s because there have been a number of EC reports released on energy externalities by a number of different countries. For more than a decade, the EC has been researching externalities for various energy technologies.

An external cost, also known as an externality, arises when the social or economic activities of one group of persons have an impact on another group and when that impact is not fully accounted, or compensated for, by the first group.

After all of the studies, if you click on the Results link in the left hand bar at the ExternE website, you can find the estimated external costs at the bottom of the page. Below is the same chart:

External costs for electricity production in the EU (in EUR-cent per kWh**)

The numbers are hardly damaging for nuclear and are comparable to renewables. This is quite the contrary to Mr. Gipe’s claims.

For those interested in nuclear risk, the World Nuclear Association has a great description of the laws around the world that cover insurance for all nuclear plants. Here’s a nugget:

It is commonly asserted that nuclear power stations are not covered by insurance, and that insurance companies don't want to know about them either for first-party insurance of the plant itself or third-party liability for accidents. This is incorrect, and the misconception was addressed as follows in 2006 by a broker who had been responsible for a nuclear insurance pool: "it is wrong [to believe] that insurers will not touch nuclear power stations. In fact, wherever they are available to private sector insurers, Western-designed nuclear installations are sought-after business because of their high engineering and risk management standards. This has been the case for fifty years."

Be sure to check out more on that page.

This concludes our three part critique of Grist’s campaign. I’m sure this won’t change many minds at Grist, but hopefully it’ll get the critics to dig and think a little deeper about nuclear before they start writing and publishing. They have a responsibility to their readers, and to history.

For those who missed it, here’s our part one and two rebuttals to Grist’s anti-nuclear campaign. Hope you enjoyed the series and I’m sure this won’t be the last time we do something like this.

0 comments:

Post a Comment